Study: LLM's in Risk Profiling

How do ChatGPT and Bard categorize investor risk profiles compared to financial advisors? By Prof. Thorsten Hens and Trine Nordlie (Deloitte Norway)

Prof. Thorsten Hens and Trine Nordlie (Deloitte Norway) investigate how well large language models (LLMs), specifically OpenAI’s ChatGPT-4 and Google’s Bard (now rebranded as Gemini), compare to professional bankers in assessing investor's risk profiles, which is a crucial aspect of financial advice.

Since strategic asset allocation is known to be the most important determinant of the investment success, accurate risk profiling is critical to ensure suitability and protection for the client.

Methodoloy

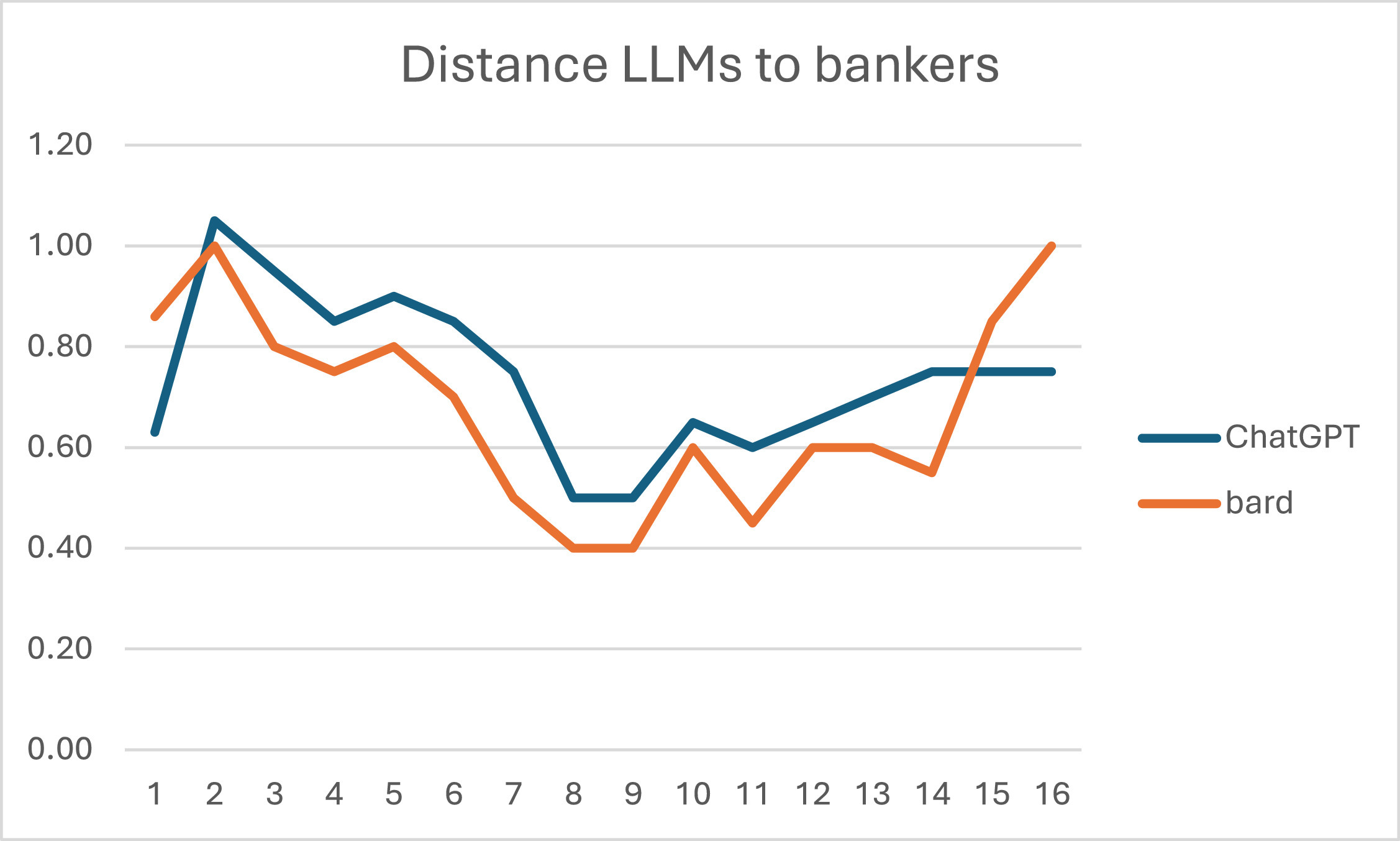

The study used ten different client cases describing investors’ financial situations, investment objectives, risk preferences, and experience. Data were collected through an online survey of bankers from the same Swiss bank, who were incentivized to rate each case on a 1–5 risk scale. ChatGPT-4 and Bard (Gemini) assessed the same cases 16 times each using the same scale.

Key Findings

-

About half of the client cases showed no significant differences between bankers’ and chatbots’ risk scores, and any differences had little economic impact

-

Compared to the chatbots, the bankers’ risk profiling scores for the ten client profiles were more variable

-

Chatbots relied on general rules, often oversimplifying details and missing specific characteristics of the clients

-

While LLMs could approximate bankers’ risk scores, their reasoning lacked depth, personalization, and contextual accuracy, which are crucial in financial advice

Conclusion

The study found that ChatGPT and Bard often produced risk profiles similar to those of bankers, with no significant differences in about half the cases and only minor economic differences overall. Still, the chatbots often relied on simple rules and missed important client details. This means they cannot replace financial advisors, but they could be used as a second opinion.

More Information:

Hens, Thorsten and Nordlie, Trine (2025). How good are LLMs in risk profiling?, https://doi.org/10.1016/j.frl.2025.108102

Further examples of contract research conducted by and in collaboration with our department can be found here:Commissioned Research at the UZH Department of Finance

Photo source: Canva