Expected and Unexpected Consequences of Political Ambiguity

Panel Discussion with Thorsten Hens, covened by Academic Guest Jędrzej Białkowski and hosted by Collegium Helveticum

Political ambiguity can shape markets, investor sentiment, and policy responses in ways that are both predictable and surprising. This panel brings together leading experts from academia and finance to explore how uncertainty in politics affects economic behavior and financial systems, from risk perceptions to strategic decision-making.

Join us for an engaging and insightful discussion with:

- Prof. Jędrzej Białkowski, University of Canterbury

- Prof. Thorsten Hens, University of Zurich

- Susanne Kundert, Head of Investments, Globalance Bank

- Dr. Jörn Spillmann, Head of Equity Strategy, Zürcher Kantonalbank

Date: 17 November 2025, 17:00 - 18:15

Location: Meridian Hall des Collegium Helveticum, Schmelzbergstrasse 25, CH-8092 Zurich, Switzerland

🌐 Reflections on our Panel: Expected and Unexpected Consequences of Political Ambiguity

Thank you to Dr. Isabella Kooij for expertly moderating an engaging discussion, and to our panel of experts for sharing their perspectives on how political ambiguity shapes markets, trust, and investor decisions:

🔹 Prof. Thorsten Hens: What does political ambiguity mean?

Prof. Hens from our UZH Department of Finance opened the discussion by explaining the concept of political ambiguity and why it matters for investors. He highlighted how the quality and reliability of political signals directly influence market behavior, strategic decisions, and the level of trust investors place in institutions.

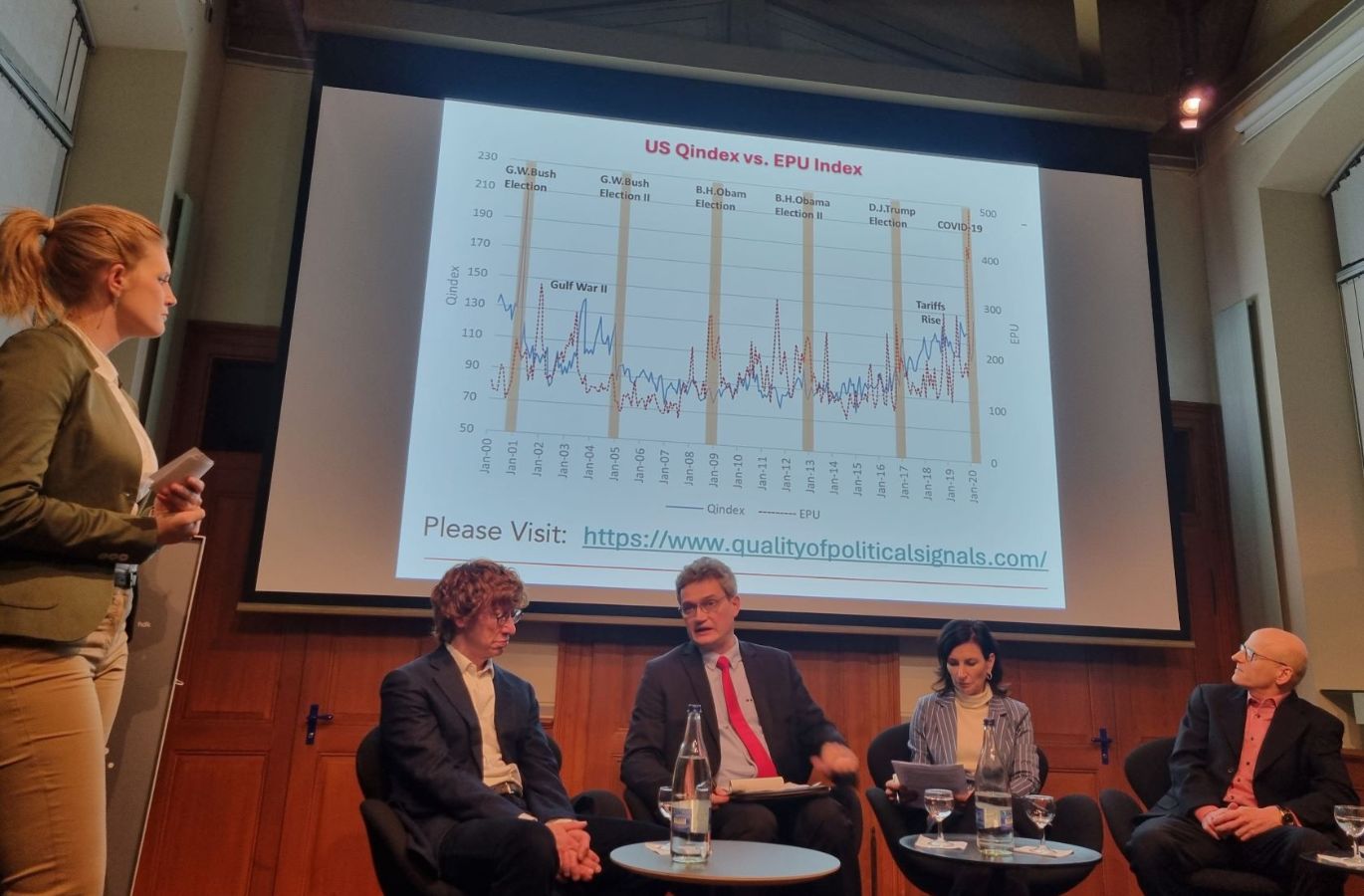

🔹 Prof. Jedrzej Bialkowski: Measuring the quality of political signals

Prof. Bialkowski, Senior Fellow at the Collegium Helveticum and convenor of the event, introduced his approach to quantifying political ambiguity, presenting the Qindex (Quality of Political Signals www.qualityofpoliticalsignals.com) which evaluates how consistent and reliable political communication is. He also explained why uncertainty increases both risk aversion and ambiguity aversion among investors, noting that financial markets and the real economy are closely intertwined.

“In an environment with high-quality political signals, one can focus on the impact of messages from the center of power rather than on the reliability of the messages themselves. However, this is not the case when the quality of political signals is low.”

— Prof. Jedrzej Bialkowski

🔹 Susanne Kundert: Transparency and trust as key decision drivers

Susanne Kundert emphasized the need for transparency, especially as clients struggle to distinguish what is truly sustainable amid changing labels and regulations. Trust in the partner and their investment processes, she noted, becomes a decisive factor.

🔹 Dr. Jörn Spillmann: Switzerland as a safe haven

Dr. Jörn Spillmann offered a powerful reminder that Switzerland’s stable and predictable environment remains a safe haven for global investors. He added an important nuance: “Ambiguity doesn’t necessarily make our job more difficult.” When political signals fall below a certain threshold of quality, they do not trigger adjustments in tactical asset allocation, an insight that reframes how investors respond to noise versus meaningful information.

Key message across the panel: Trust and transparency reduce costs, save time, and decrease uncertainty — and they remain essential factors in navigating political ambiguity.

Thank you to all panelists and participants for a stimulating and insightful discussion and the the Collegium Helveticum for hosting the event.